Back

6 Apr 2023

Crude Oil Futures: Further correction on the cards

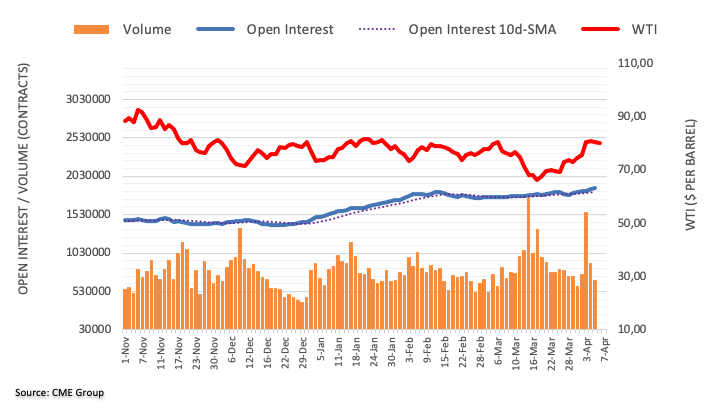

Considering advanced prints from CME Group for crude oil futures markets, open interest increased by around 21.4K contracts on Wednesday, reaching the sixth consecutive daily build. Volume, instead, went down for the second straight session, this time by nearly 223K contracts.

WTI: To fill or not to fill the gap?

Crude oil prices gave away some gains on Wednesday amidst rising open interest, which is suggestive that further retracement appears likely in the very near term. Against that, it remains to be seen whether the WTI could fill Monday’s upside gap in response to the OPEC+ decision. On this, the next support is seen at $75.68 (daily high March 31).