Gold unstoppable above $1200; Bullish momentum targets 100-DMA

Currently, Gold spot is trading at 1211.29, up +1.32% or 1595-pips on the day, having posted a daily high at 1215.33 and low at 1193.76.

Precious metals and 'safe-haven' assets were flooded today with massive capital flows from investors and traders due to the ongoing aggressive agenda that the US president is following.

Historical data available for traders and investors indicates during January that Gold spot had the best trading day at +1.41% (Jan.5) or 1664-pips, and the worst at -1.11% (Jan.18) or (1331)-pips.

Gold is back; Thank You Donald!

Bloomberg reports, "Gold futures rose for a second day, set for the biggest monthly gain since June, on investor concern over moves by Trump that included barring entry by citizens from seven predominantly Muslim nations and firing the acting U.S. attorney general for refusing to enforce the order. The dollar headed for a third straight decline against a basket of 10 currencies, and U.S. stocks slid."

The report continues, "Confusion over U.S trade and immigration policies has helped rekindle haven demand for gold, which in December capped its biggest quarterly decline in more than three years. Money is also flowing back to precious metals as speculation mounts that the Federal Reserve may be more cautious in raising U.S. interest rates amid concerns Trump’s policies could stifle economic growth. Protests from New York to Atlanta to Detroit were held Sunday."

How could Trump's protectionism affect FED´s decisions?

Valeria Bednarik, Chief Analyst at FXStreet, notes, "Back mid-January and in a speech titled "The goals of monetary policy and how we pursue them," FED's Yellen said that the FOMC expects to raise interest rates "a few times" per year, until achieving a 3% rate by 2019, boosting the greenback temporarily, as the effect of her hawkish comments diluted in a non-so-hawkish speech a few days afterwards."

She further writes, "In the meantime, Mr. Trump keeps signing trade-protectionism executive orders. These kinds of measures could affect growth, as imposing import tariffs won't go unnoticed by other world´s major powers. And Wall Street's decline is clearly reflecting fears of such happening. The biggest risk is that this kind of policy will backfire in the inner market. Another point of conflict comes from Trump's infrastructure promises. Such policies would need low rates to guarantee a competitive exchange rate and attractive borrowing costs, opposing to FED's latest policy that suggests an acceleration in the pace of rate hikes."

Technical levels to watch

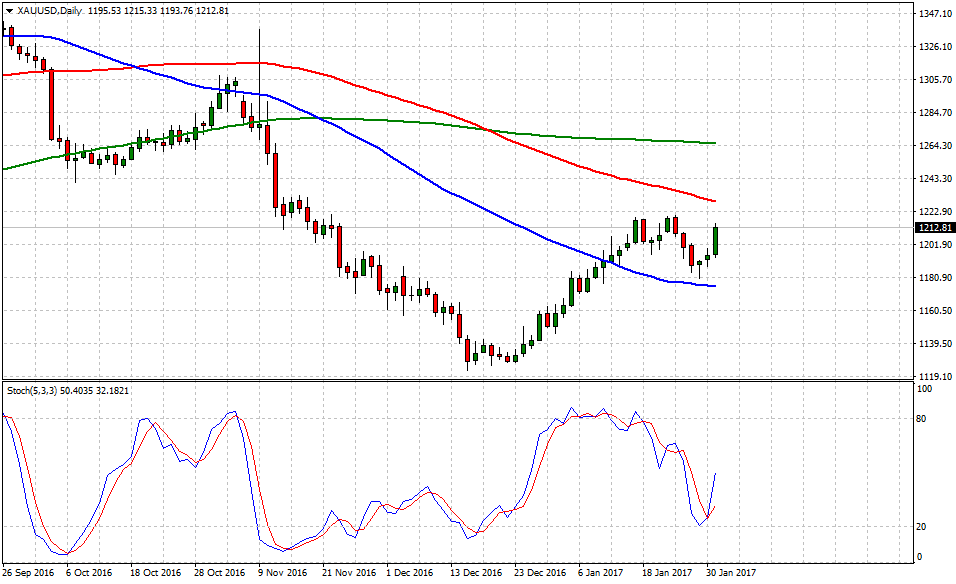

In terms of technical levels, upside barriers are aligned at 1228 (100-SMA), then at 1265 (200-SMA) and above that at 1300 (psychological mark). While supports are aligned at 1193 (today's low), later at 1175 (50-DMA) and below that at 1150 (horizontal support). On the other hand, Stochastic Oscillator (5,3,3) seems to reverse and head north, therefore, there is evidence to expect further Gold gains in the near term.

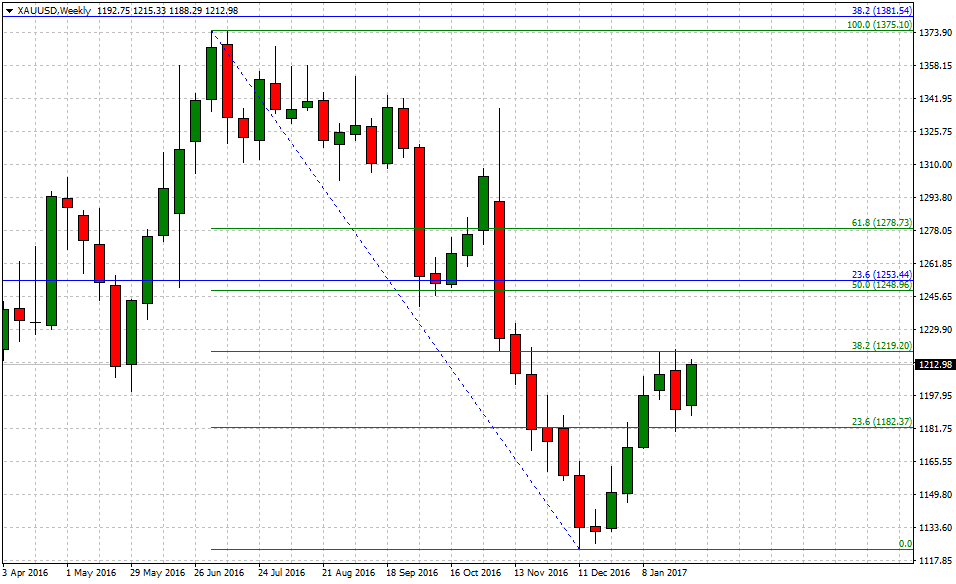

On the long-term view, Gold battles a consolidation predicament. To the upside, 1219 level (short-term 38.2% Fib) becomes the immediate resistance and challenge that Gold bugs need to break to have a fighting chance against the evident bearish trend in place from 1375 (high July 3). To the downside, 1182 (short-term 23.6% Fib) provides further support against the almighty US dollar, then an open and close below this level would accelerate the slide towards the previous bottom at 1122 (low Dec.11).

USD softening gathers pace after Trump accusations of calculated devaluation