GBP/USD flirting with tops near 1.3020

The British Pound has started the week on a firm note, lifting GBP/USD further north of the 1.3000 handle ahead of the opening bell in the Old Continent.

GBP/USD tests 2-day highs

Cable is advancing for the second session in a row so far on Monday, always against the backdrop of the persistent selling bias around the greenback. The US Dollar Index, in the meantime, stays depressed in the area of 93.65/60, levels last seen in June 2016.

After bottoming out in the 1.2930 region last week, the pair managed to regain some buying interest and retake the psychological 1.3000 limestone, as concerns over Brexit and UK politics seem to have taken a breather.

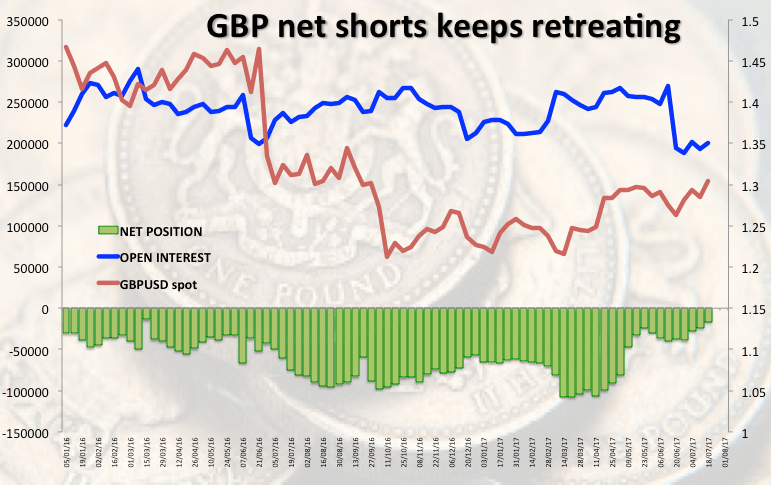

Sustaining the momentum in GBP, the speculative community trimmed their net shorts to the lowest level since early November 2015 during the week ended on July 18, as per the latest CFTC report.

Further news from the UK cited the government remains focused in clinching the best deal with the EU.

GBP/USD levels to consider

As of writing the pair is gaining 0.19% at 1.3019 and a break above 1.3038 (high Jul.20) would open the door to 1.3115 (high Jul.14) and finally 1.3127 (2017 high Jul.18). On the downside, the immediate support aligns at 1.2987 (10-day sma) followed by 1.2948 (21-day sma) and finally 1.2930 (low Jul.20).

Furthermore, the daily RSI (14) stays around 57, while the MACD remains within the positive territory.