GBP/CHF finds resistance at 1.3200 ahead of UK budget report on Tuesday

- UK budget report scheduled on Tuesday at 11.30 GMT.

- SNB rate decision on Thursday at 8.30 GMT .

The GBP/CHF is currently trading at around 1.3118 virtually unchanged on Monday so far. Last week the GBP/CHF appreciated more than 290 pips and is now trading less than 40 pips away above its daily 100-period simple moving average.

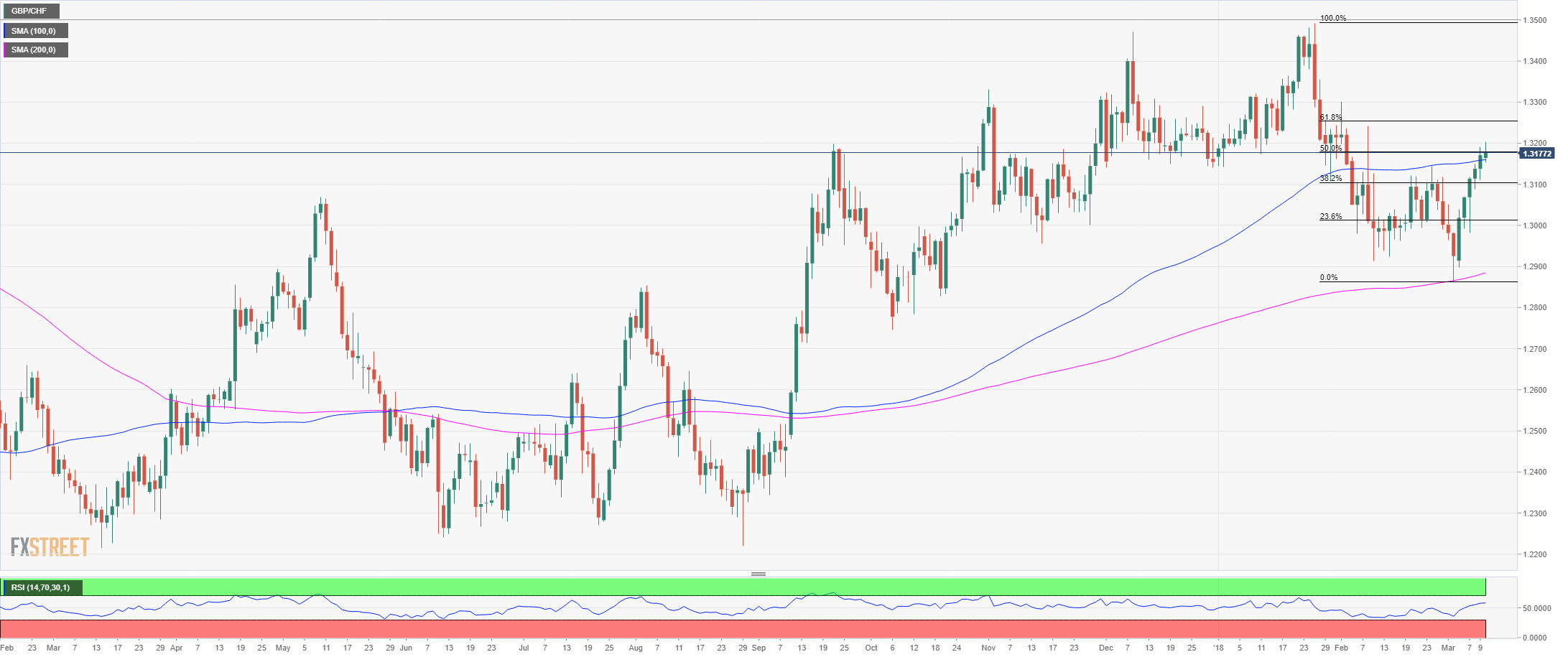

GBP/CHF daily chart

The GBP/CHF found resistance at 1.3180 which is the 50% Fibonacci retracement. Previously the 1.3180-1.3200 has been an important supply/demand zone.

The UK budget report is scheduled on Tuesday at 11.30 GMT. Market participants will get more details over GDP estimates, fiscal stimulus and spending and borrowing forecasts. However, the main risk event for the UK is likely going to be on March 22nd at the European summit where a conclusion on the EU-UK trade deal should be announced.

Thursday will see the Swiss National Bank interest rates decision and quarterly bulletin. The SNB is expected to keep interest rates unchanged according to Danske Bank. More info here.

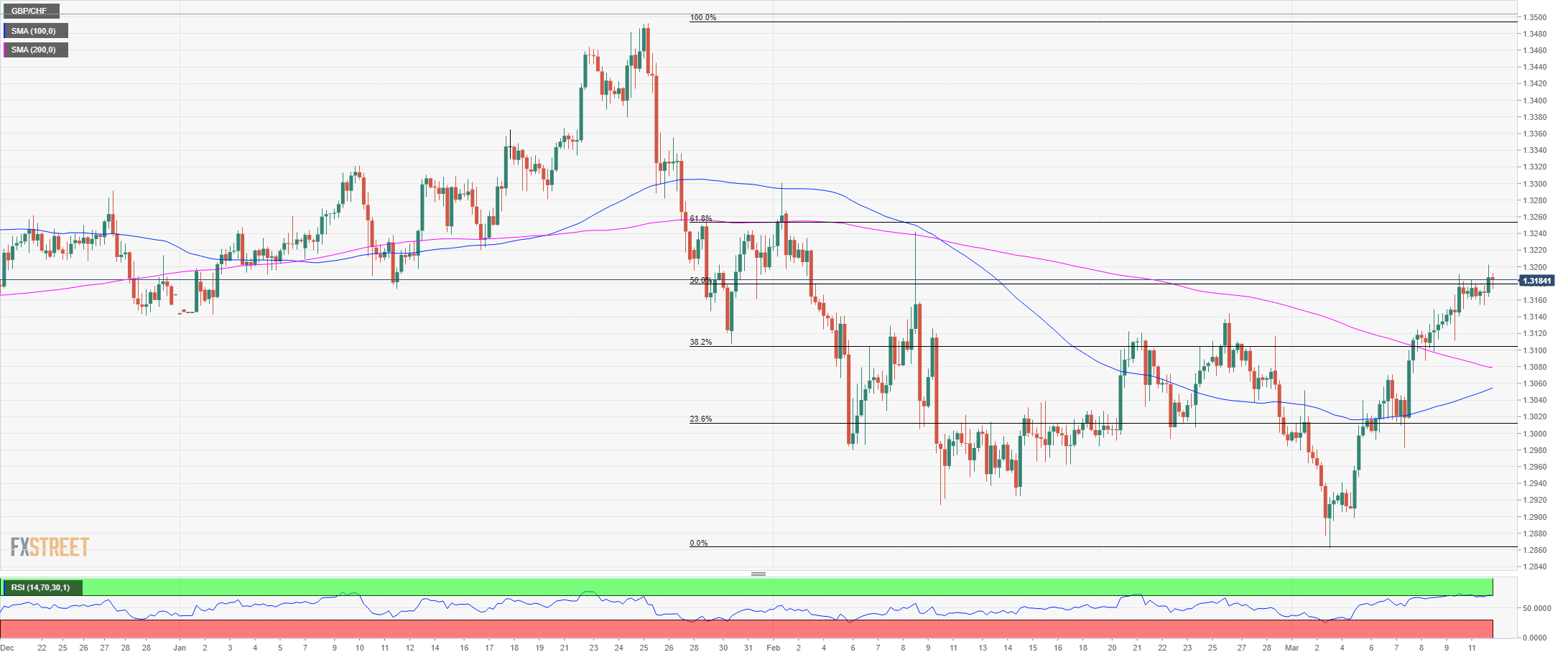

GBP/CHF 4-hour chart

Intraday resistance is seen at 1.3200 which is the current high of the day. Further up, resistance is seen at 1.3260 which is the 61.8% Fibonacci retracement of the 1.3483/1.2861 decline. To the downside, intraday support is seen at 1.3154 which is close to the low of the day. Further down, support is seen at 1.3100 which is the 38.2% Fibonacci retracement followed by 1.3020 which is the 23.6% Fibonacci retracement.