Gold down as Kudlow says to sell gold

- Kudlow says “I would buy King Dollar and I would sell gold.”

- Gold is still capped by the 1,360.00 multi-month resistance.

The precious metal is trading at above 1,317 down 0.54% on the day as Kudlow jawboned about the US dollar.

Larry Kudlow was appointed by Trump as the new White House top economic advisor on Wednesday. In a comment, he said that he would like to see the USD “a wee bit stronger” and went so far as giving a trade recommendation: “I would buy King Dollar and I would sell gold.” He didn’t give any detail of the time frame nor entry and exit levels though.

Regardless of what Kudlow's recommendations are, the USD is having some issues; the trade war initiated by Trump and the ever-increasing account deficit to name a few, according to Alvise Marino, FX strategist at Credit Suisse. She adds: “Kudlow speaks about the strong dollar and says all the right things in terms of what markets want to hear, but at the same time, you have much wider fiscal funding requirements. There’s so many more headwinds and they’re much more significant.”

The greenback has slumped 2.7% since the start of 2018, after an 8.5% loss in 2017. Sell contracts on the currency outnumber buy bets by 149,000 contracts, according to the latest data from the Commodity Futures Trading Commission. Aversion for the USD is also seen in ETF flows as well, with investors increasingly moving capital out of hedge funds in favor of European and Japanese stocks without currency protection.

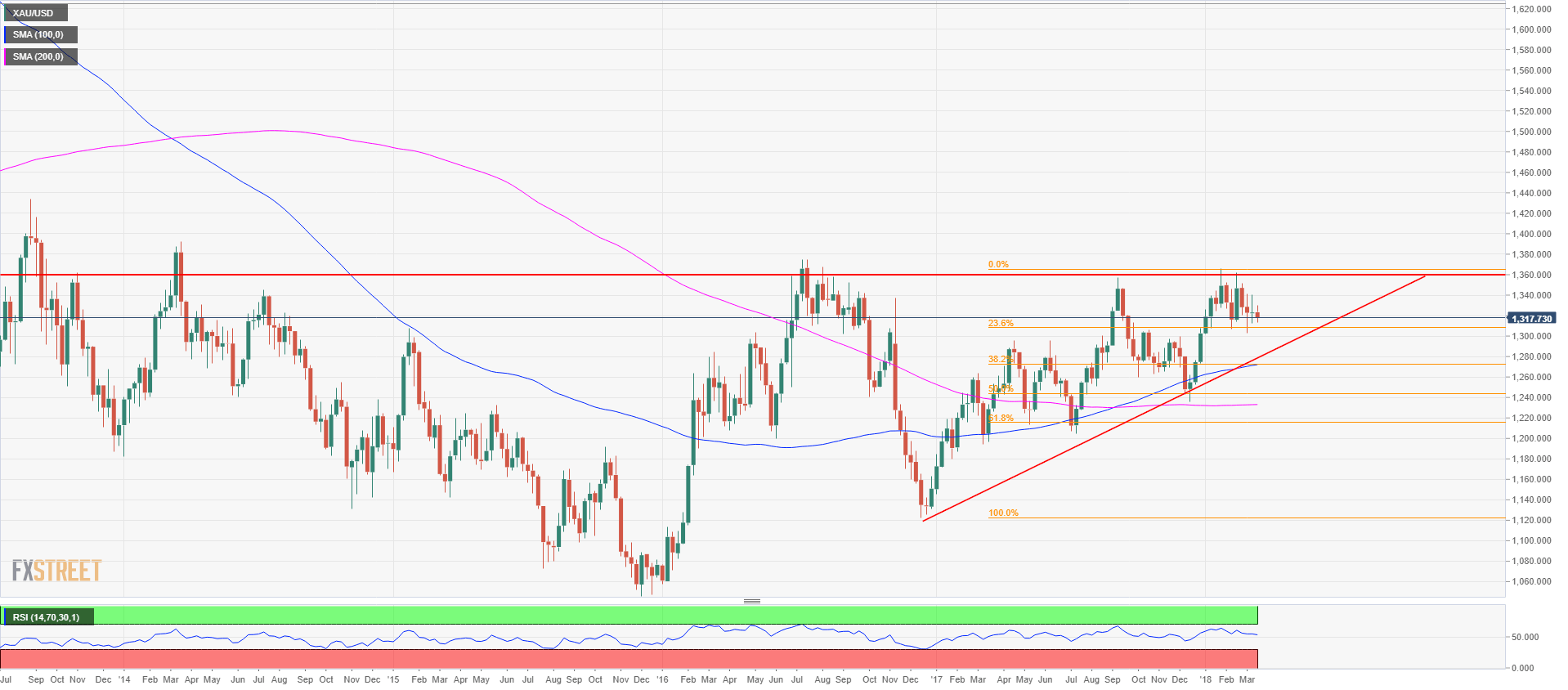

Gold weekly chart

On the technical front, Gold seems poised for a pullback in the coming weeks. 1,360 has rejected advances and the market is lacking clear momentum. Support is now seen at the 1307 level, the 23.6% Fibonacci retracement from the December 2016-January 2018 up leg. If the level gets broken to the downside then the next support is seen at 1,270, 38.2% Fibonacci retracement, which also coincides with an ascending trendline. Key resistance is the 1,360 multi-month resistance and the 1400 psychological figure.