USD/MXN jumps to 19.00 as Emerging Markets tumble on Turkish crisis

- A terrible day for Emerging Market currencies, including the Mexican peso, hit by risk aversion.

- USD/MXN jumps to test 19.00: a quick ride from 3-month lows to 2-week highs.

The USD/MXN pair rose sharply for the second day in a row on Friday boosted by jitters around Emerging Market. Latin American assets fell sharply affected by the crisis in Turkey. The Turkish Lira lost 15% creating concerns about the exposition of European banks. The peso lost 1.15% on Friday (2.20% in two days), the Brazilian real 1.50% and the Argentine peso 4.10%.

Global equity markets fell more than 1% and even US stocks were hit. The Dow Jones was down 0.75% near the end of the session. US yields move lower and the greenback soared. The US Dolllar Index broke above previous monthly highs and climbed to 96.25, the highest level since July of last year.

An abrupt end to MXN rally

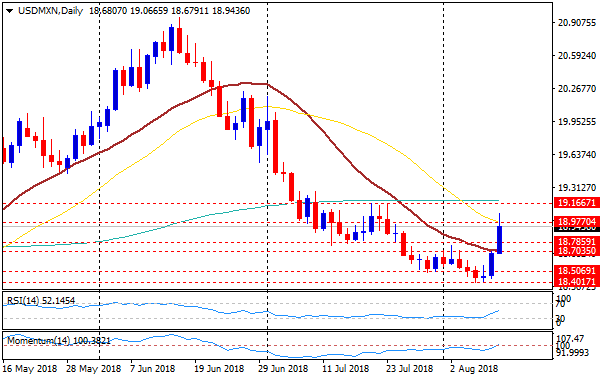

USD/MXN bottomed at 18.39 on Wednesday, the lowest level since mid-April. The area around 18.40 capped the decline that started in June from near 21.00. On Thursday it changed the short-term trend and started to rise.

On Friday, USD/MXN broke above the 20-day moving average and also on top of the 18.70 key resistance, adding more strength to the rally. It peaked at 19.07, the highest intraday level since July 23 and then pulled back. It was about to end around 18.95, below the 19.00 handle that now it the immediate barrier.

The technical outlook now favors the upside, with Momentum moving to the upside and price holding on top of the 20-day MA. Only a decline back below 18.70 could remove the short-term upside pressure. While a consolidation on top of 19.15 would signal more gains ahead.