Back

15 Nov 2018

Crude Oil WTI Technical Analysis: Black Gold stabilizing after the recent carnage and climactic sell-off - Bull target at $59.00 a barrel

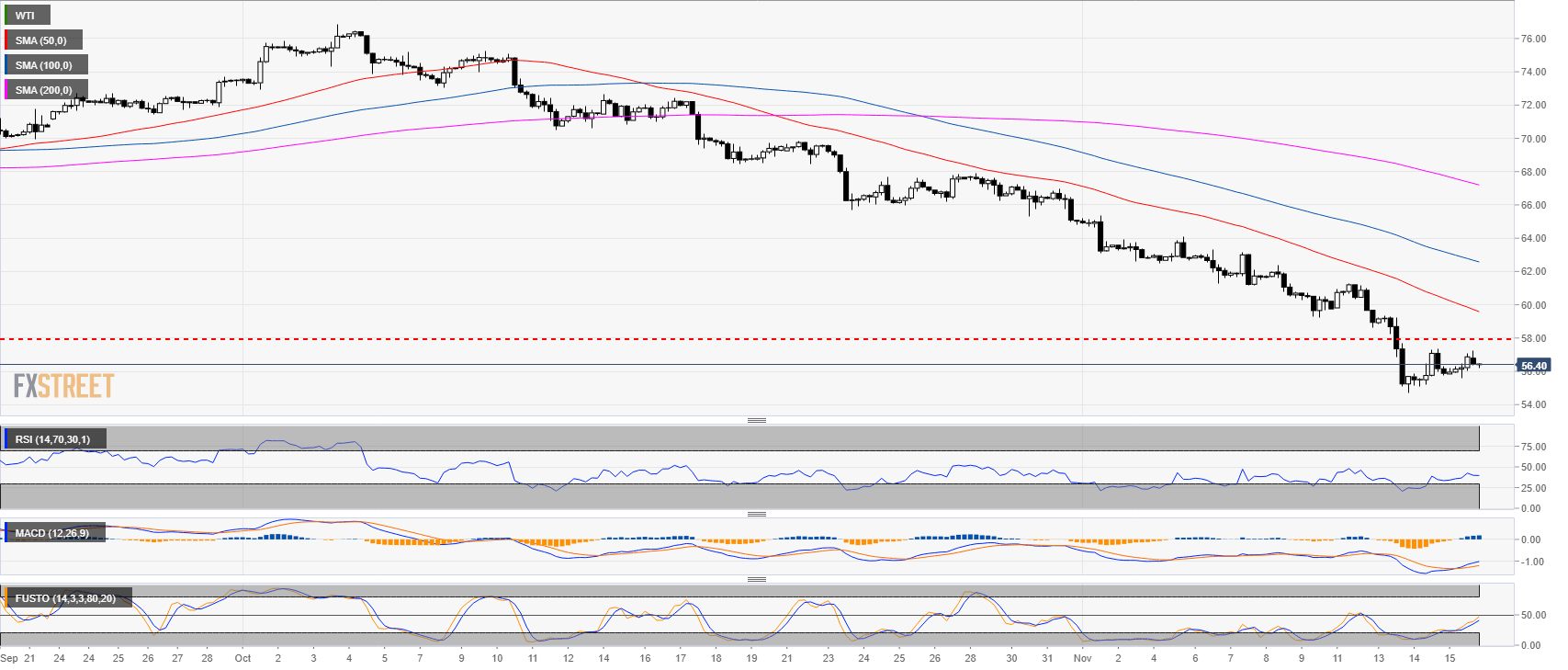

Crude oil weekly chart

- Crude oil has erased the yearly gains as it plunged below the 58.00 level.

-636779107148827218.png)

Crude oil 4-hour chart

- Oil is trading in a steep bear trend below the 50, 100 and 200-period simple moving average.

- The MACD indicator crossed over from below while the RSI and Stochastic are rising but still below the 50 line.

- Oil is far away from its 50 SMA. All suggesting potential oversold condition.

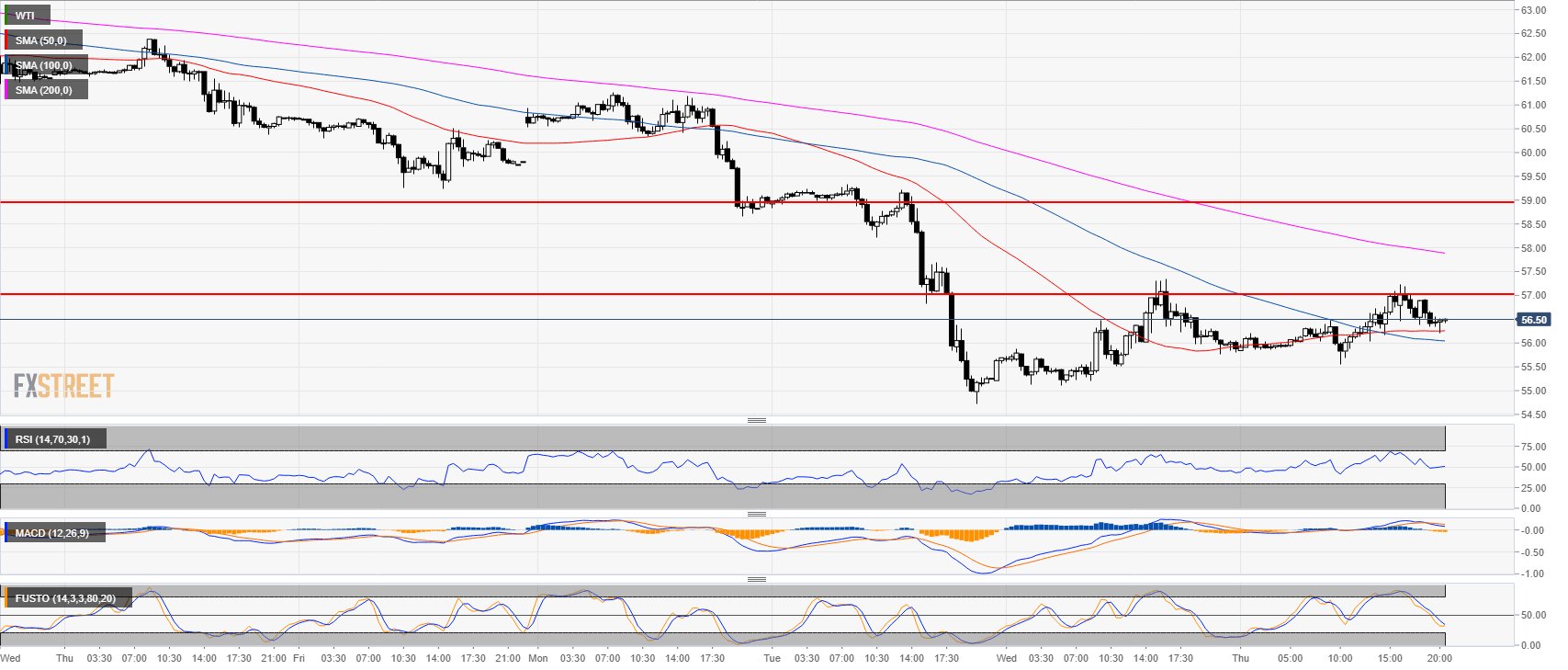

Crude oil 30-minute chart

- Bulls are trying to break above $57.00 a barrel. They tried to do so on Wednesday and this Thursday.

- The 50 and 100 SMA are supporting the market.

- A successful break would most likely lead to a strong bullish recovery to 59.00.

Additional key levels at a glance:

WTI

Overview:

Last Price: 56.47

Daily change: 59 pips

Daily change: 1.06%

Daily Open: 55.88

Trends:

Daily SMA20: 63.01

Daily SMA50: 68.5

Daily SMA100: 68.37

Daily SMA200: 68.35

Levels:

Daily High: 56.06

Daily Low: 55.81

Weekly High: 63.05

Weekly Low: 59.24

Monthly High: 76.25

Monthly Low: 64.86

Daily Fibonacci 38.2%: 55.91

Daily Fibonacci 61.8%: 55.96

Daily Pivot Point S1: 55.77

Daily Pivot Point S2: 55.67

Daily Pivot Point S3: 55.52

Daily Pivot Point R1: 56.02

Daily Pivot Point R2: 56.17

Daily Pivot Point R3: 56.27