GBP/JPY Technical Analysis: Yen selling gives the Guppy a leg up past 145.50

- The GBP/JPY saw a soft rise over the past twenty-four hours, lifting from the week's open near 144.75 to a near-term high of 145.75.

- The near-term bounce is likely owing to a softening of the JPY, and risk-on/off flows could see a firm hand on market direction this week.

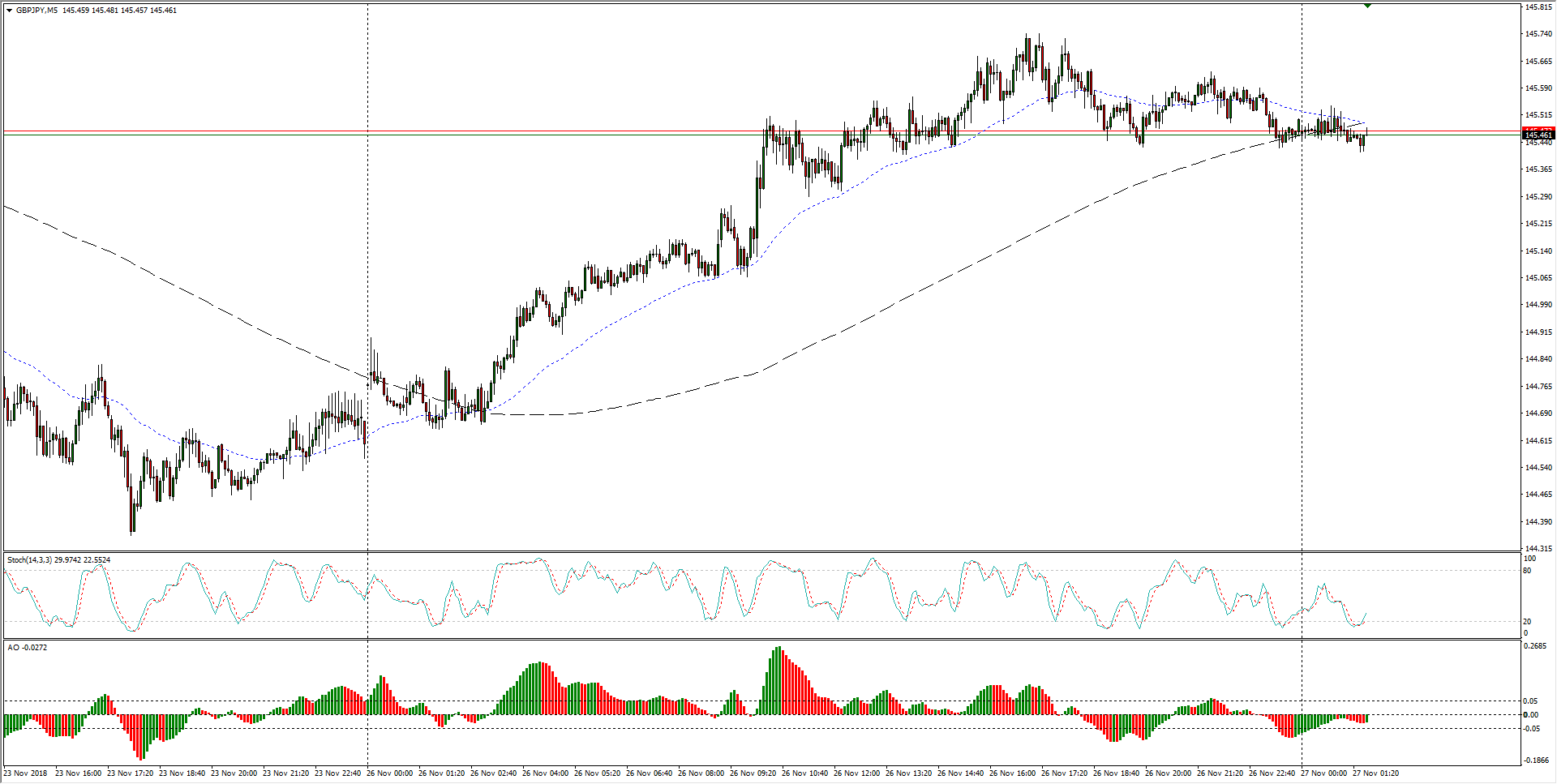

GBP/JPY Chart, 5-Minute

- The past two weeks have seen the Guppy struggle to regain a bullish poise after risk-off took the pair down from highs just below the major 150.00 handle, but bidders have managed to halt declines and price in a floor from the 144.00 level.

GBP/JPY Chart, 30-Minute

- The GBP/JPY continues to cycle in a rough range through the medium-term, constrained by a ceiling from the 148.00-150.00 region while stuck on softly-rising lows from 144.50, highlighting the Guppy's exposure to broad-market risk flows.

GBP/JPY Chart, 4-Hour

GBP/JPY

Overview:

Today Last Price: 145.46

Today Daily change: 76 pips

Today Daily change %: 0.525%

Today Daily Open: 144.7

Trends:

Previous Daily SMA20: 146.07

Previous Daily SMA50: 146.91

Previous Daily SMA100: 145.78

Previous Daily SMA200: 147.07

Levels:

Previous Daily High: 145.56

Previous Daily Low: 144.35

Previous Weekly High: 145.96

Previous Weekly Low: 144.01

Previous Monthly High: 149.52

Previous Monthly Low: 142.78

Previous Daily Fibonacci 38.2%: 144.81

Previous Daily Fibonacci 61.8%: 145.1

Previous Daily Pivot Point S1: 144.18

Previous Daily Pivot Point S2: 143.66

Previous Daily Pivot Point S3: 142.97

Previous Daily Pivot Point R1: 145.39

Previous Daily Pivot Point R2: 146.08

Previous Daily Pivot Point R3: 146.6