When is Canadian CPI and how could it affect USD/CAD?

Canadian CPI Overview

Friday's economic docket highlights the release of Canadian consumer inflation figures for the month of December, scheduled to be published at 1330 GMT. The headline CPI is anticipated to have dropped 0.4% m/m in December and the yearly rate is seen holding steady at 1.7%, missing the official target of 2%.

According to Analysts at TD Securities: “Energy prices will exert a heavy drag with gasoline prices down another 7% on the month, although a large base effect and stronger core (ex. food & energy) prices will help keep inflation stable.”

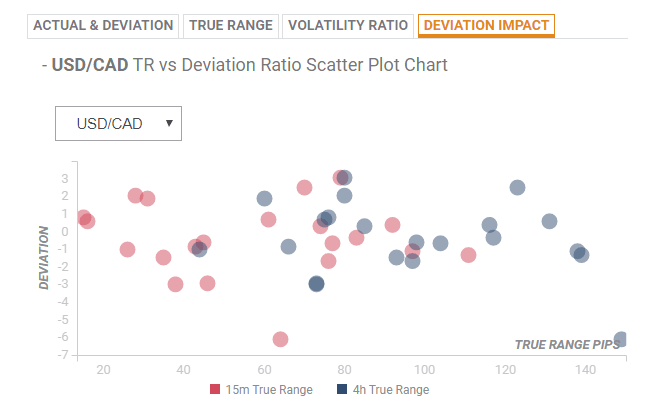

Deviation impact on USD/CAD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction on the pair is likely to be around 26-pips during the first 15-minutes and could get extended to 45-pips in the following 4-hours in case of a relative deviation of -1.02.

How could it affect USD/CAD?

Ahead of the important release, the pair was seen trading with a mild negative bias just above mid-1.3200s and a follow-through selling, led by hotter than expected inflation figures, could pave the way for a retest of 100-day SMA support near the 1.3185 region.

Alternatively, a weaker reading might inspire bulls to retake the 1.3300 handle and aim towards challenging 50-day SMA support break-point, now turned strong hurdle near the 1.3340 region.

Key Notes

• Canada’s inflation Preview: Inflation data unalter the outlook for ongoing policy tightening towards neutral

• USD/CAD flirting with daily lows, just above mid-1.3200s ahead of Canadian CPI

• USD/CAD Technical Analysis: Firming up support for a run at 1.3300

About BoC's Core CPI

Consumer Price Index Core is released by the Bank of Canada. “Core” CPI excludes fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation, and tobacco products. These volatile core 8 are considered as the key indicator for inflation in Canada. Generally speaking, a high reading anticipates a hawkish attitude by the BoC, and that is said to be positive (or bullish) for the CAD.