Back

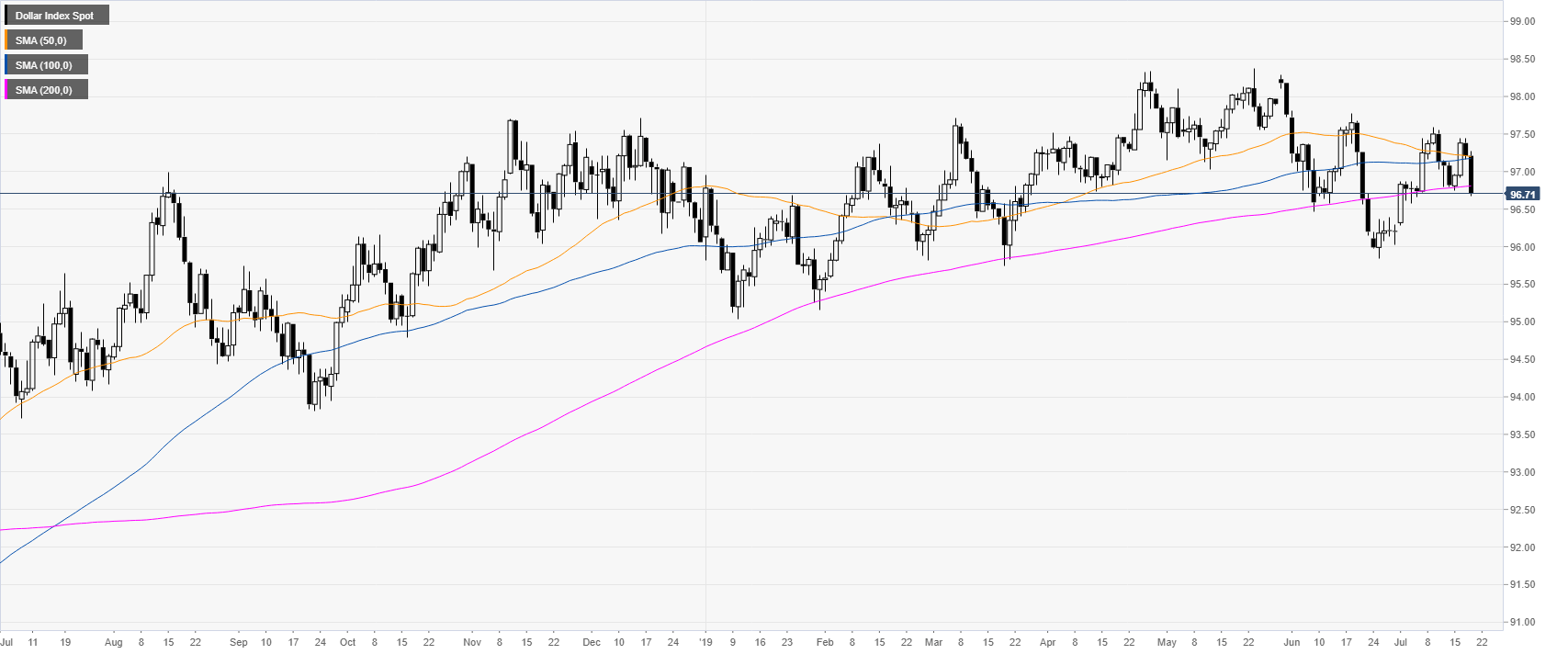

DXY daily chart

19 Jul 2019

US Dollar Index technical analysis: DXY gets slammed on Fed’s William comments

- DXY breaks below the 97.00 figure and the 200 DSMA.

- The level to beat for bears is 96.60 and 96.36.

DXY daily chart

The US Dollar Index (DXY) broke below the 97.00 handle and the 200-daily simple moving average (DSMA).

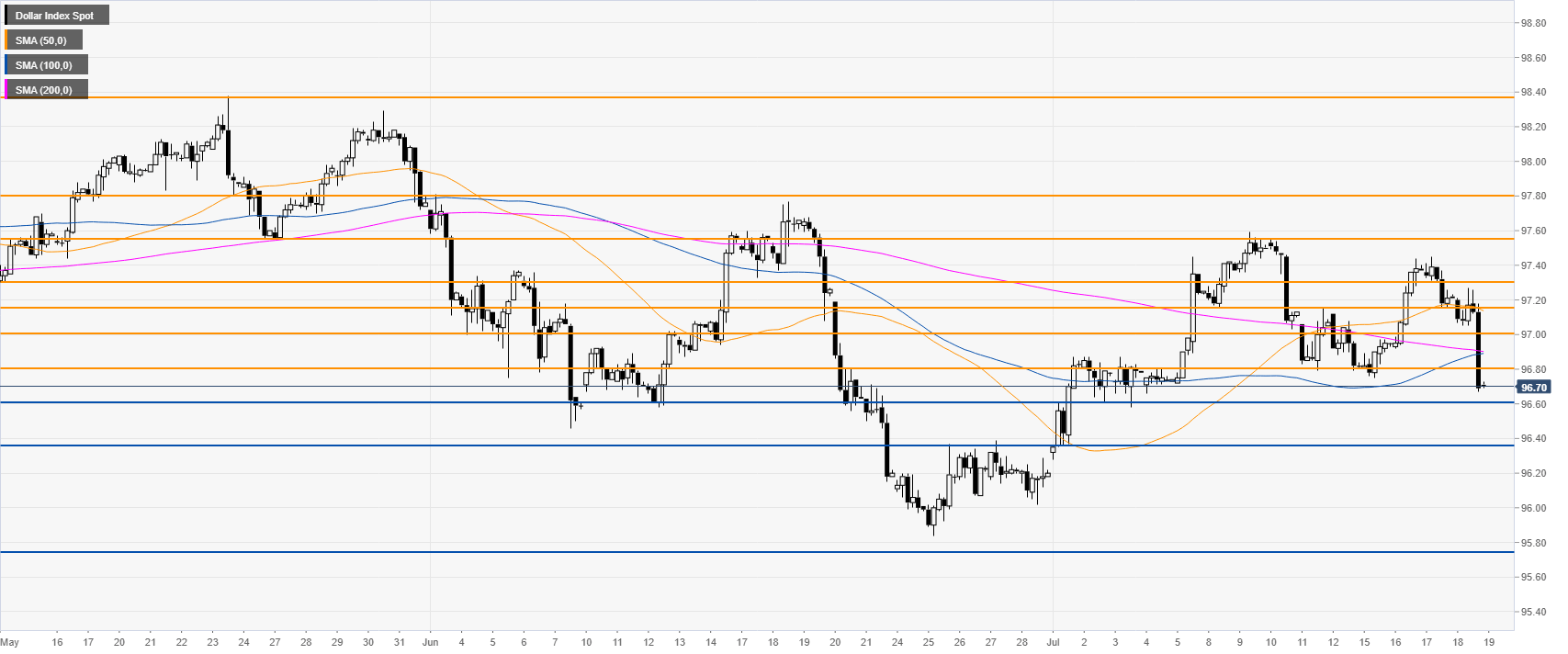

DXY 4-hour chart

The market is trading below its main SMAs suggesting bearish momentum in the medium term. Bears would need a break below 96.60 and 96.36.

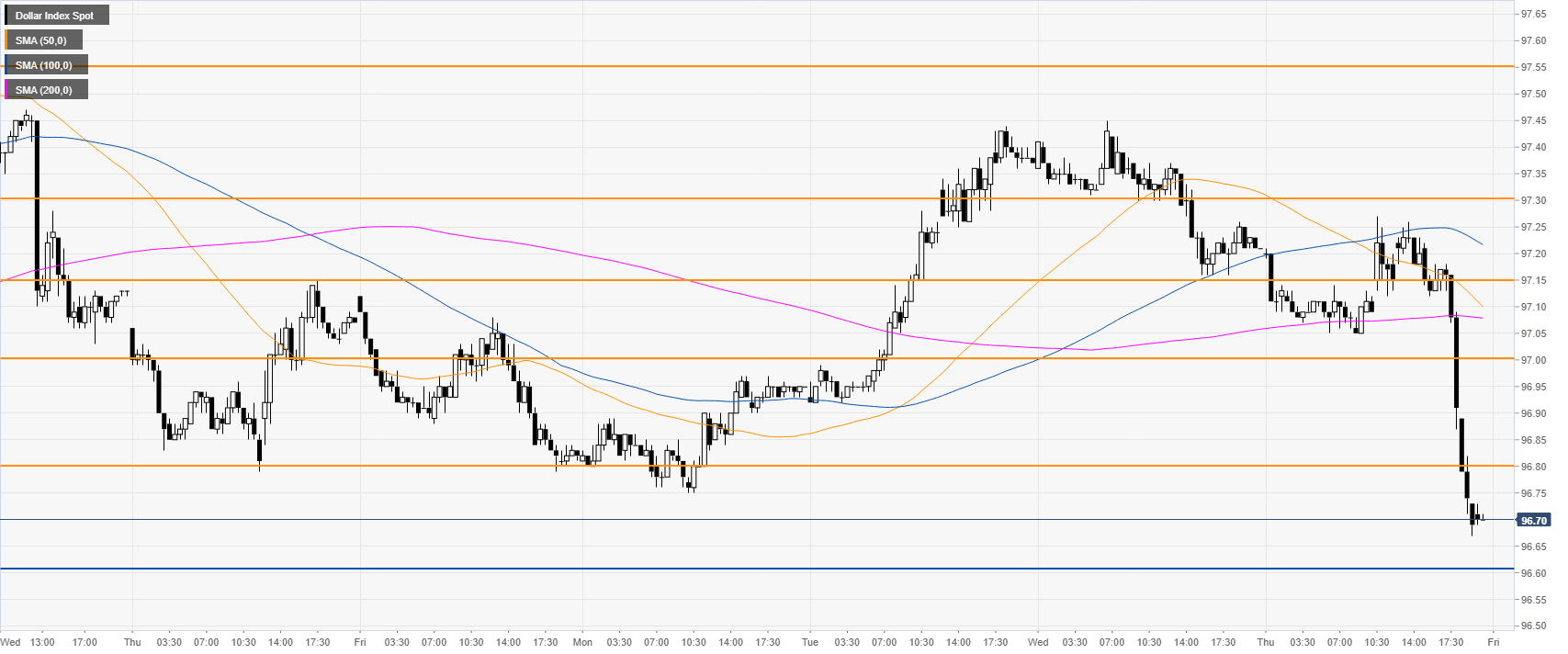

DXY 30-minute chart

The bears took the market by surprise and brought the index near the weekly lows. Resistances are seen at 96.80 and the 97.00 figure.

Additional key levels