Back

19 Oct 2019

USD/JPY technical analysis: Greenback ends the week below the 108.50 level

- This week USD/JPY consolidated the October bull run.

- The level to beat for bears is the 108.16 support.

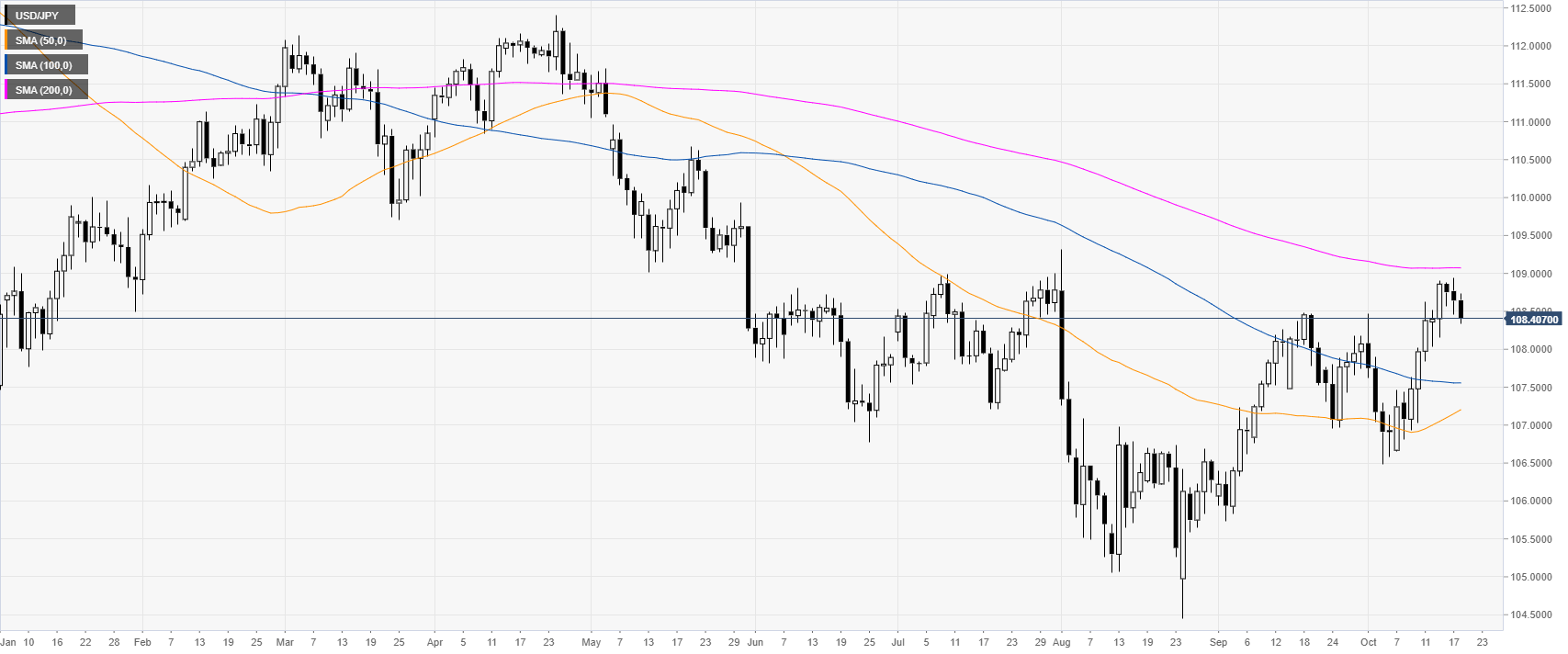

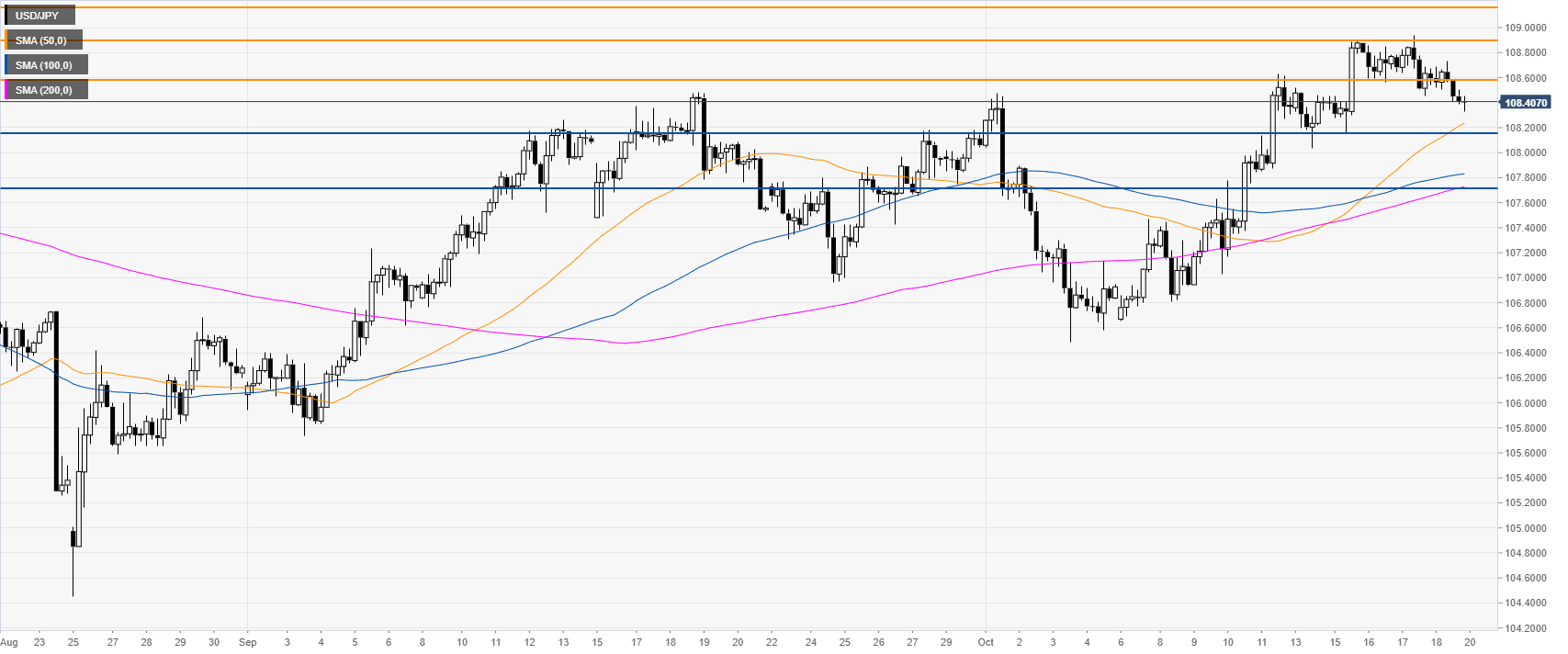

USD/JPY daily chart

USD/JPY is trading in a bear trend below its 200-day simple moving average (DSMA). The spot is currently retracing down after the October bull run.

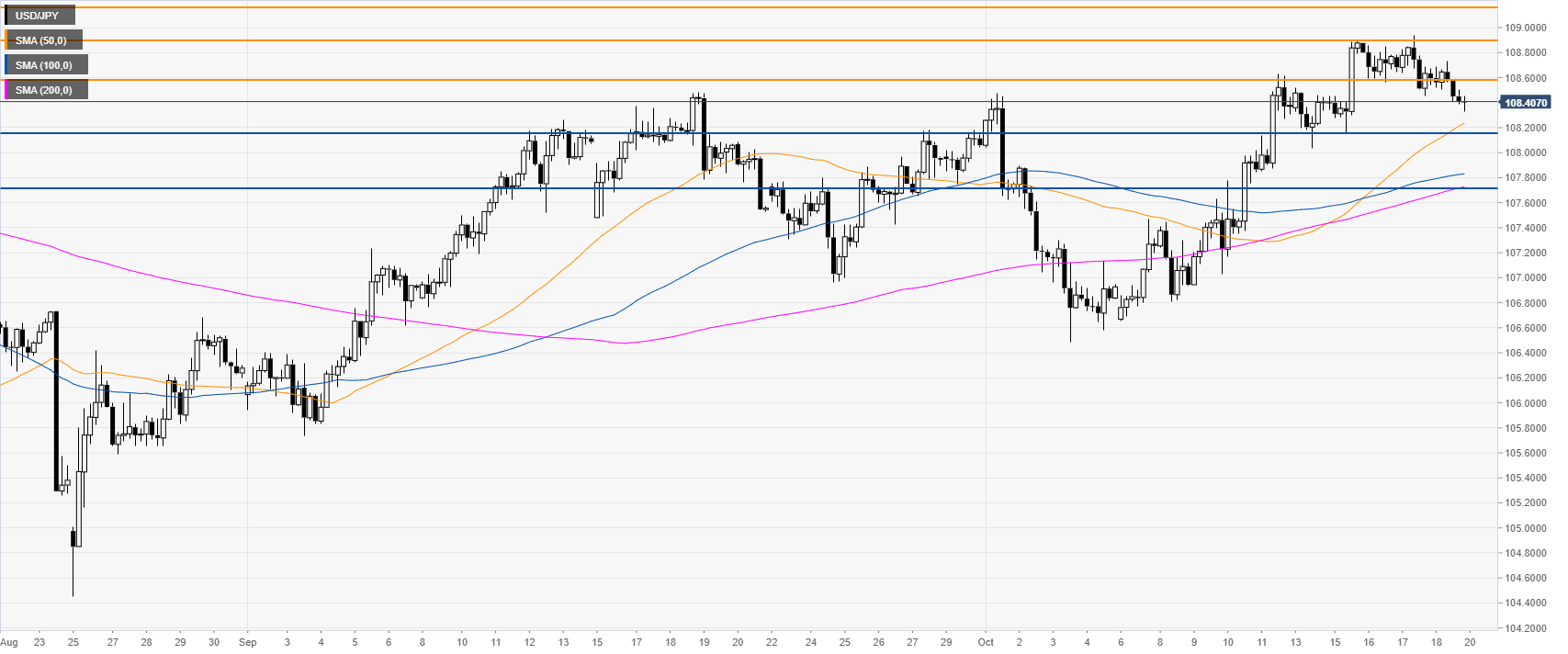

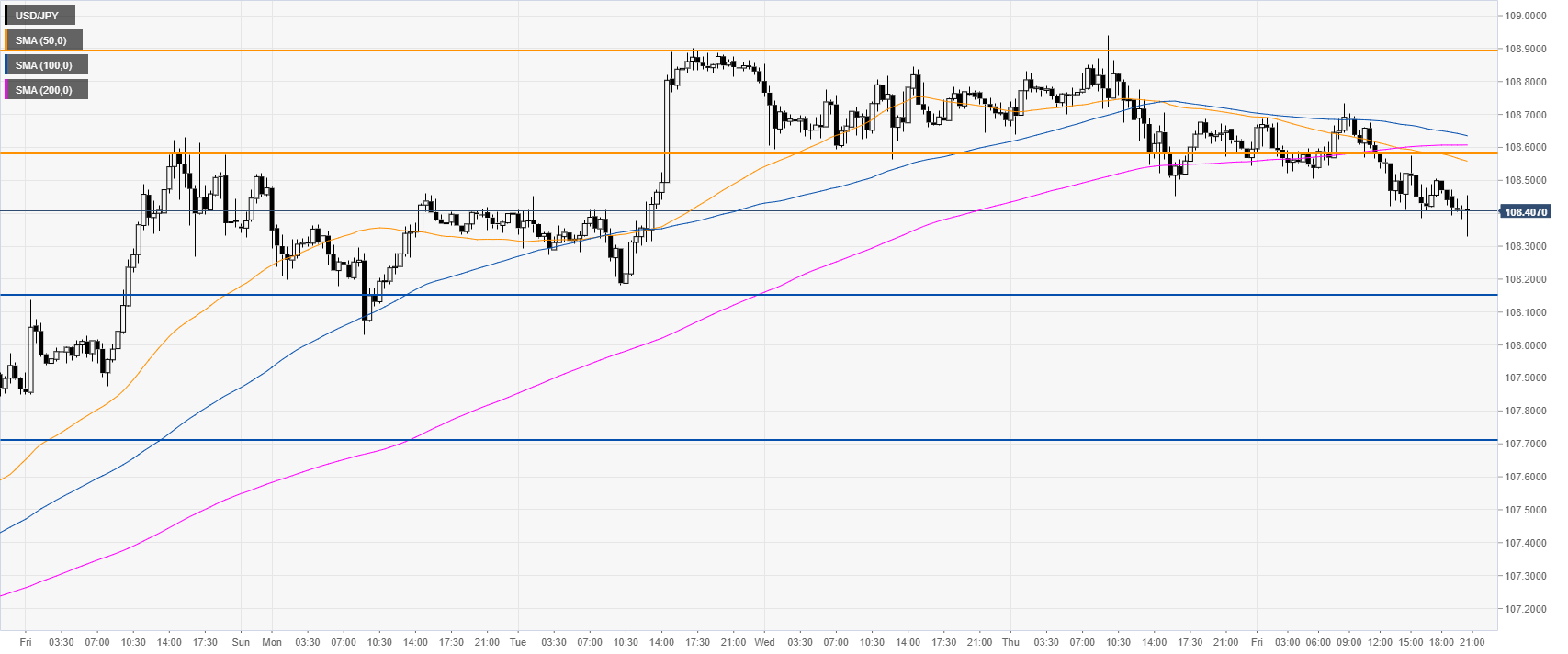

USD/JPY four-hour chart

USD/JPY is above the main SMAs on the four-hour chart, suggesting a positive momentum in the medium term. The level to beat for buyers is the 108.56 resistance followed by the 108.90 level, according to the Technical Confluences Indicator.

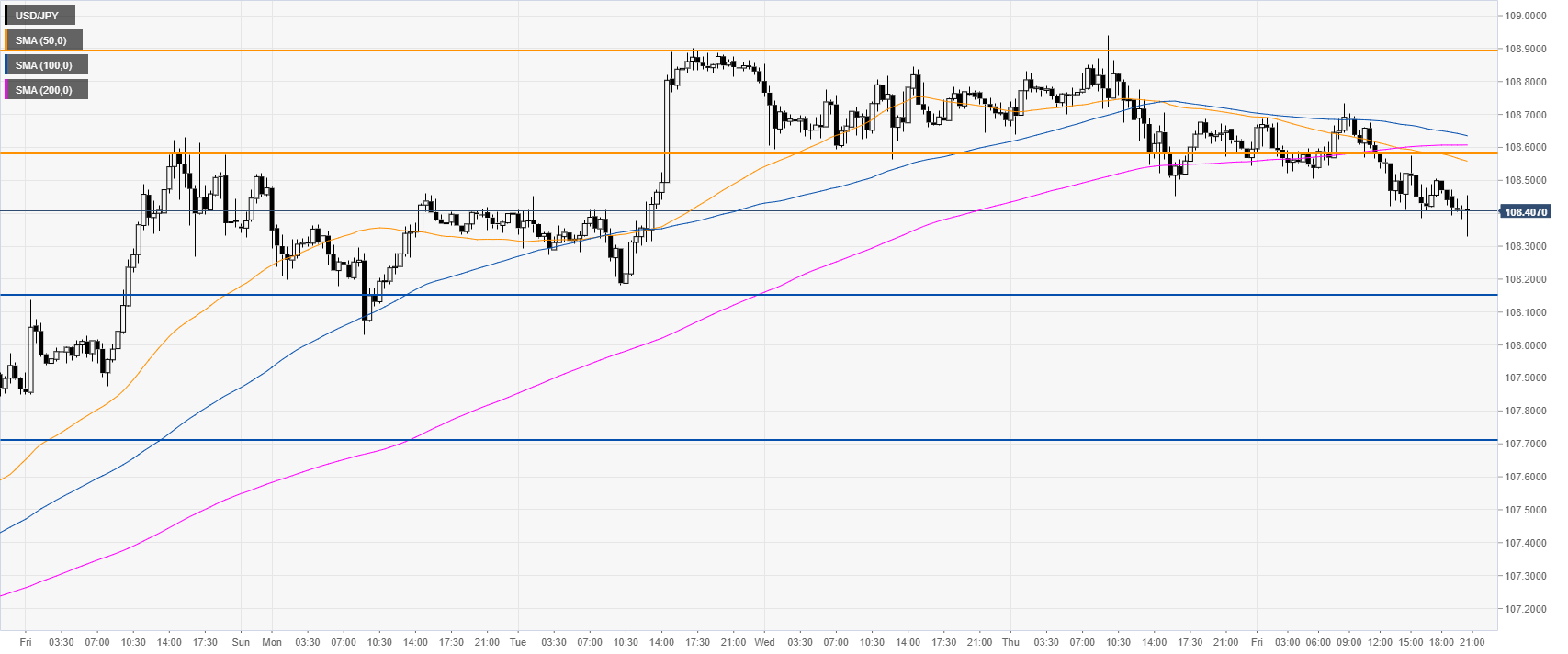

USD/JPY 30-minute chart

USD/JPY is trading below its primary SMAs, suggesting a bearish bias in the near term. Next week, the sellers might target the support levels at 108.16 and 107.70, according to the Technical Confluences Indicator.

Additional key levels