When are the UK retail sales and how could they affect GBP/USD?

UK Retail Sales Overview

The UK retail sales, scheduled to be published later this session at 0930 GMT, are expected to come in at 0.3% MoM in November, following -0.1% seen in October. Total retail sales are seen arriving at 2.1% over the year in the reported month, down from 3.1% booked previously.

Meanwhile, core retail sales, stripping the basket off motor fuel sales, are seen rising 0.3% MoM while arriving at +1.9% YoY.

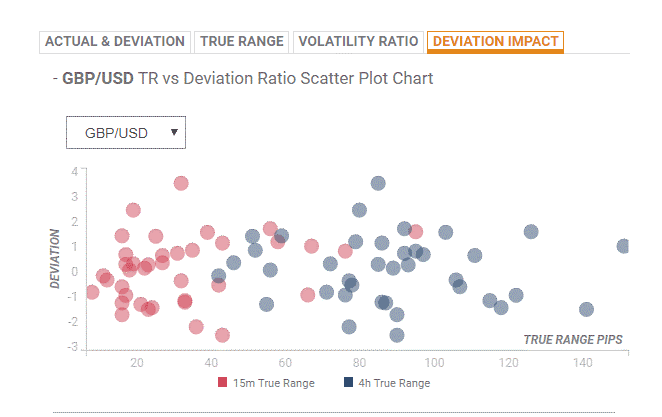

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 70 pips in deviations up to 3.5 to -1.5, although in some cases, if notable enough, can fuel movements of up to 100 pips.

How could it affect GBP/USD?

FXStreet’s Analyst Anil Panchal notes: “Considering the pair’s sustained trading below the 10-week-old rising trend line, October month high near 1.3010 and 38.2% Fibonacci retracement of September-December upside, at 1.2915, are on sellers’ radars. Alternatively, pair’s rise beyond the support-turned-resistance, at 1.3125 now, will have to cross 23.6% Fibonacci retracement level of 1.3145 to meet Monday’s low around 1.3320.”

At the press time, the Cable is looking to regain the 1.31 handle amid broad-based US dollar strength and ahead of the BOE decision and Queen's speech.

Key Notes

BoE and Riksbank meeting amongst market movers today – Danske Bank

Forex Today: Trump’s impeachment caps dollar gains, Aussie jobs boost AUD; focus on BOE, Brexit drama

Bank of England Rate Decision Preview: Back to Brexit

About the UK Retail Sales

The retail sales released by the Office for National Statistics (ONS) measures the total receipts of retail stores. Monthly per cent changes reflect the rate of changes in such sales. Changes in Retail Sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive, or bullish for the GBP, while a low reading is seen as negative or bearish.