Back

25 Mar 2020

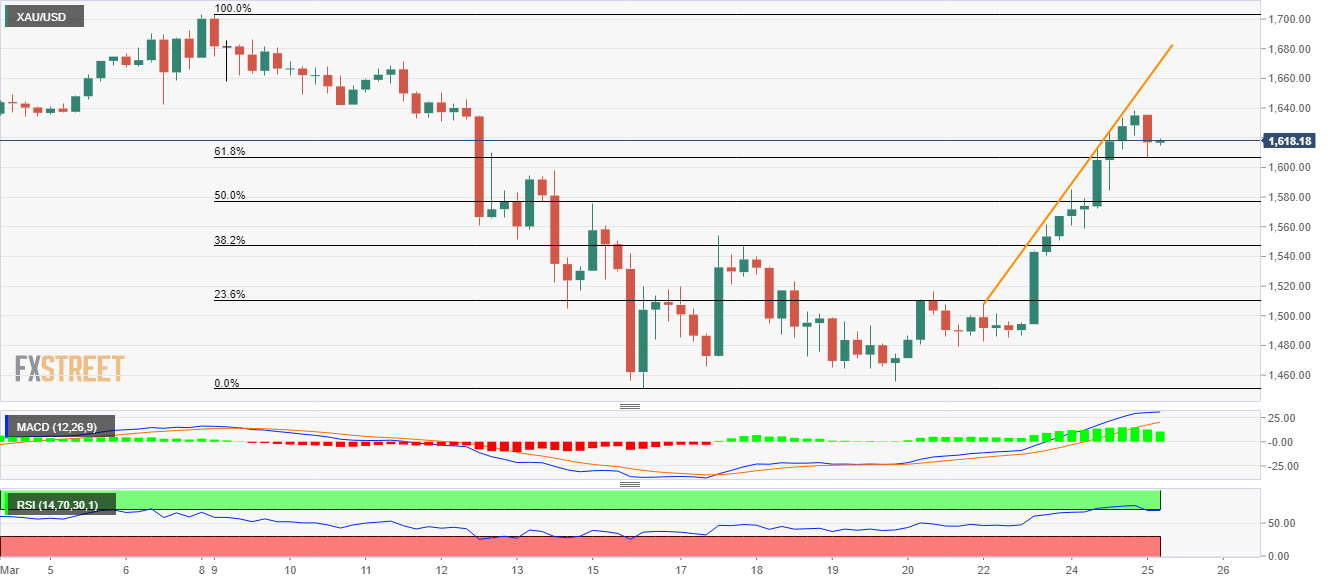

Gold Price Analysis: 61.8% Fibonacci questions pullback targeting $1,600

- Gold prices step back from two-week high.

- Key Fibonacci retracement support, bullish MACD can question the sellers.

- Buyers may follow the weekly resistance line for short-term direction.

Following its failure to cross $1,640, Gold prices slip to $1,617, down 0.75%, ahead of the European session on Wednesday.

While overbought RSI could be considered as a reason for the latest pullback, 61.8% Fibonacci retracement of March 09-16 fall, near $1,607, seems to hold the key for the metal’s drop towards 1,600 mark.

In a case where the bullion stays below $1,600, 50% Fibonacci retracement could be of interest to the sellers.

On the upside, buyers will enter once the quote rises again beyond $1,640 to aim for the short-term rising trend-line, currently at $1,671.

Given the metal’s sustained run-up past-$1,671, the monthly top beyond $1,700 will be on the bulls’ radars.

Gold four-hour chart

Trend: Bullish