NZD/USD Price Analysis: Buying spree towards 0.6450 pauses despite upbeat China data

- NZD/USD bulls catch a breather near a three-month high with a top of 0.6432 after China’s Caixin Services PMI.

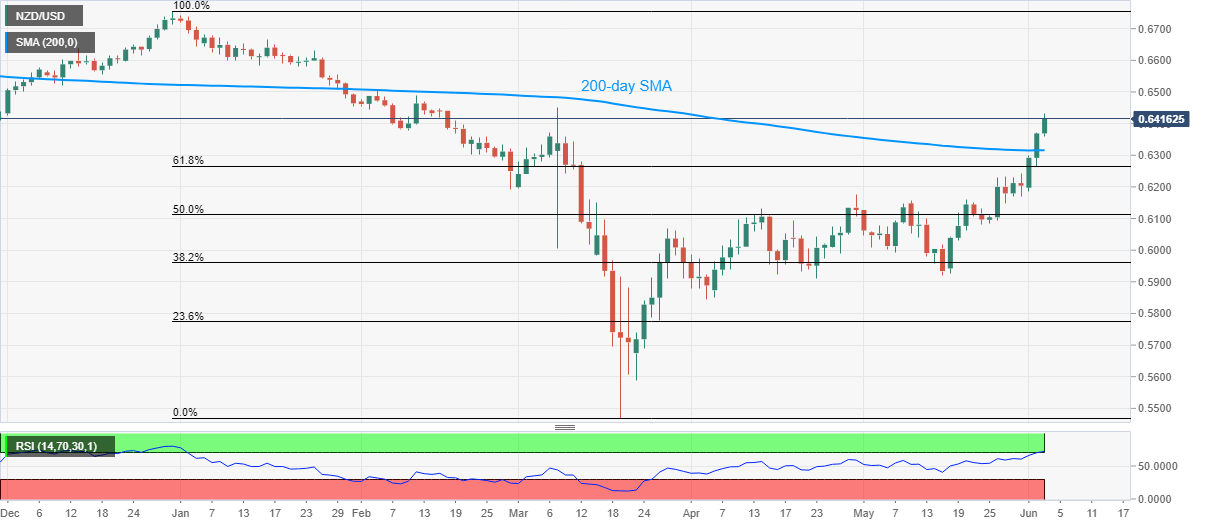

- Overbought RSI conditions, March month top question further upside.

- 200-day SMA, 61.8% Fibonacci retracement can challenge the short-term sellers.

NZD/USD recedes from the March month top to 0.6415 but remains 0.77% up on a day, even after China’s Caixin Services PMI rose in May. The data published during early Wednesday suggest a hike to 55.00 versus 50.3 previous readouts.

Read: China Caixin Services PMI for May bunces back to growth, highest since late 2010 55.0 vs 44.4 in April

Other than the data, overbought RSI conditions and nearness to March month top, surrounding 0.6450, increases the odds of the pair’s pullback moves.

In doing so, a 200-day SMA level of 0.6315 and 61.8% Fibonacci retracement level of the pair’s fall from December 31, 2019, to March 19, 2020, at 0.6265, will be on the sellers’ radars.

Should the quote slips below 0.6265 on a daily closing basis, 0.6230 and April month high near 0.6175 might return to the charts.

Alternatively, an upside clearance of 0.6450 will enable the bulls to challenge February month’s high near 0.6500.

NZD/USD daily chart

Trend: Pullback expected