AUD/CHF Price Analysis: 4HR bulls about to make their moves

The price of AUD/CHF is under the spotlight as from both a fundamental and technical standpoint, there are compelling developments in place.

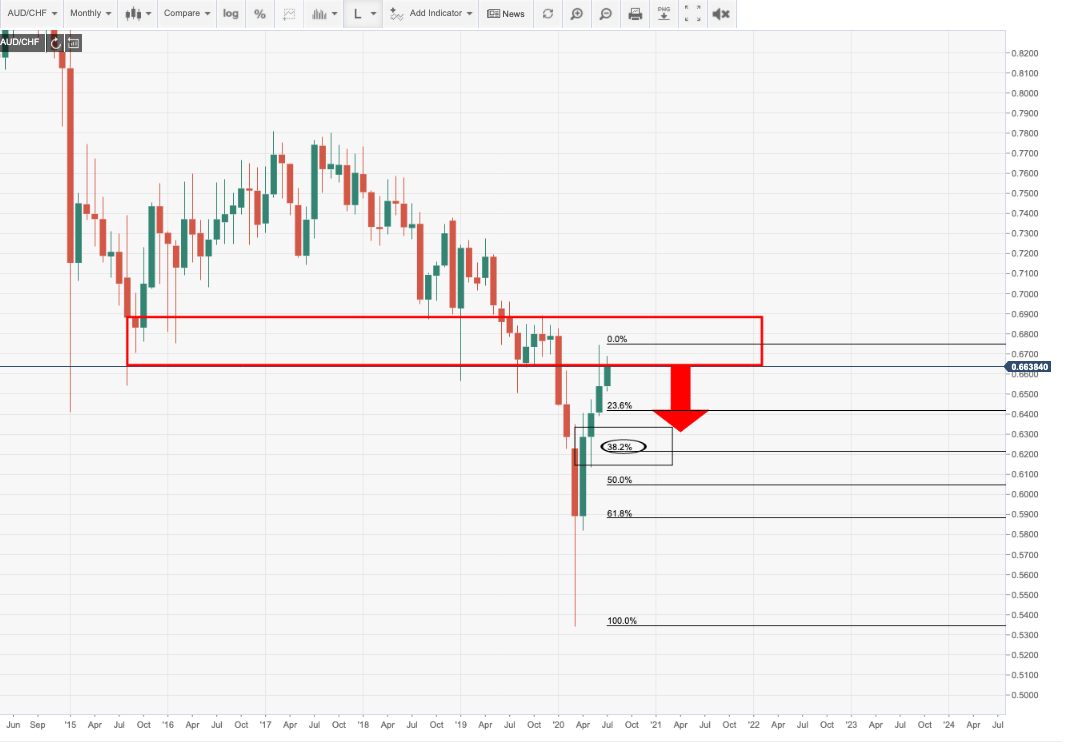

Risk-off tones are emerging in the Chinese and US trade war saga while Australian coronavirus new cases are mounting day by day which threatens the state of play for the AID bulls.

CHF is a renowned risk-off currency and the US dollar could well find a bid on the trade war risks and general profit-taking.

Nevertheless, the technicals remain bullish, to a degree.

The following is a top-down analysis on the cross which gives some food for thought for both the bulls and bears, the near term and longer-term.

The bulls are running into a supply zone

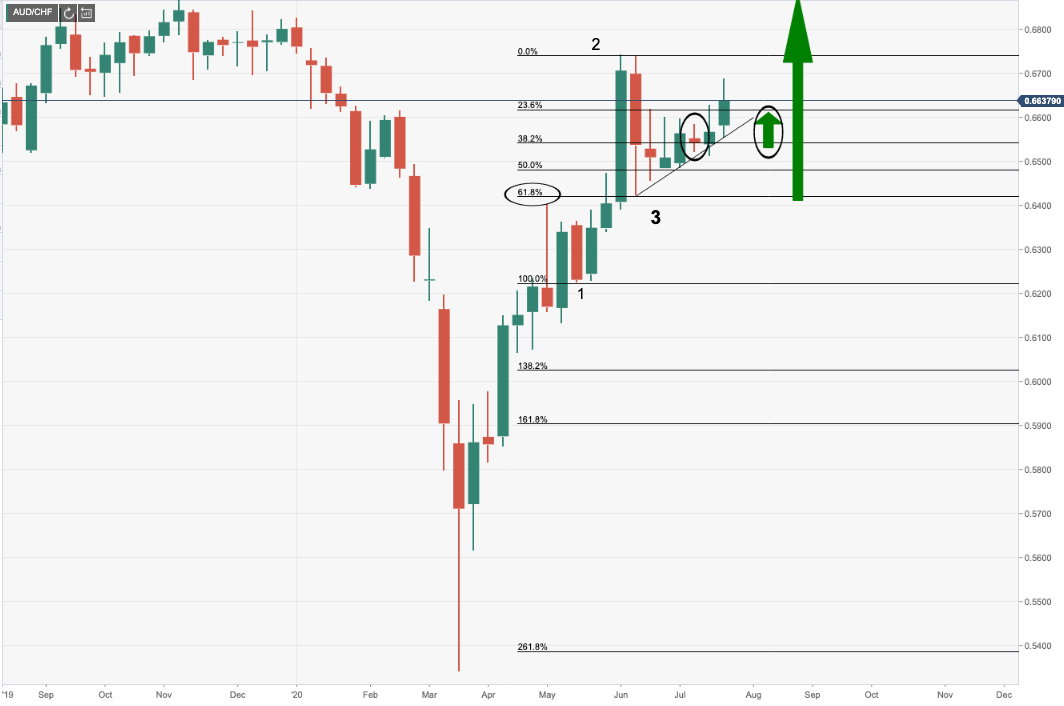

Weekly wave-3 and trend-line support

Bulls are in charge and wave 3 should be an impulse extension to higher highs with little interruption.

However, a W formation is taking shape which could attract a pullback to the eclipsed red candle's highs.

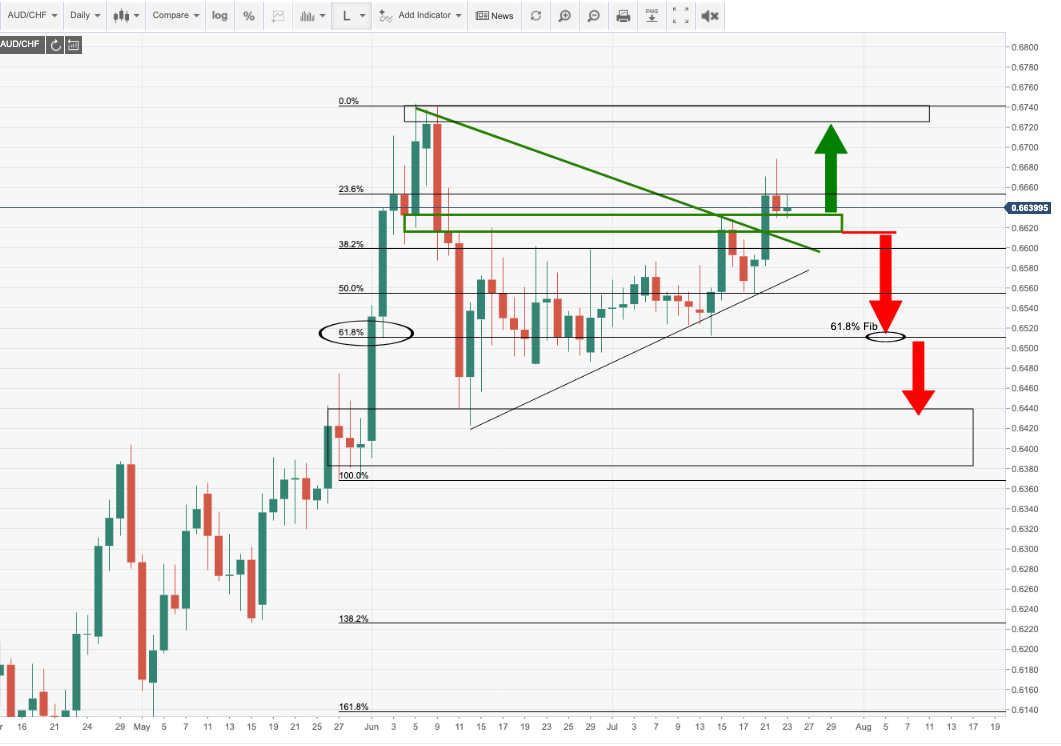

Daily support structures, bulls in charge while above

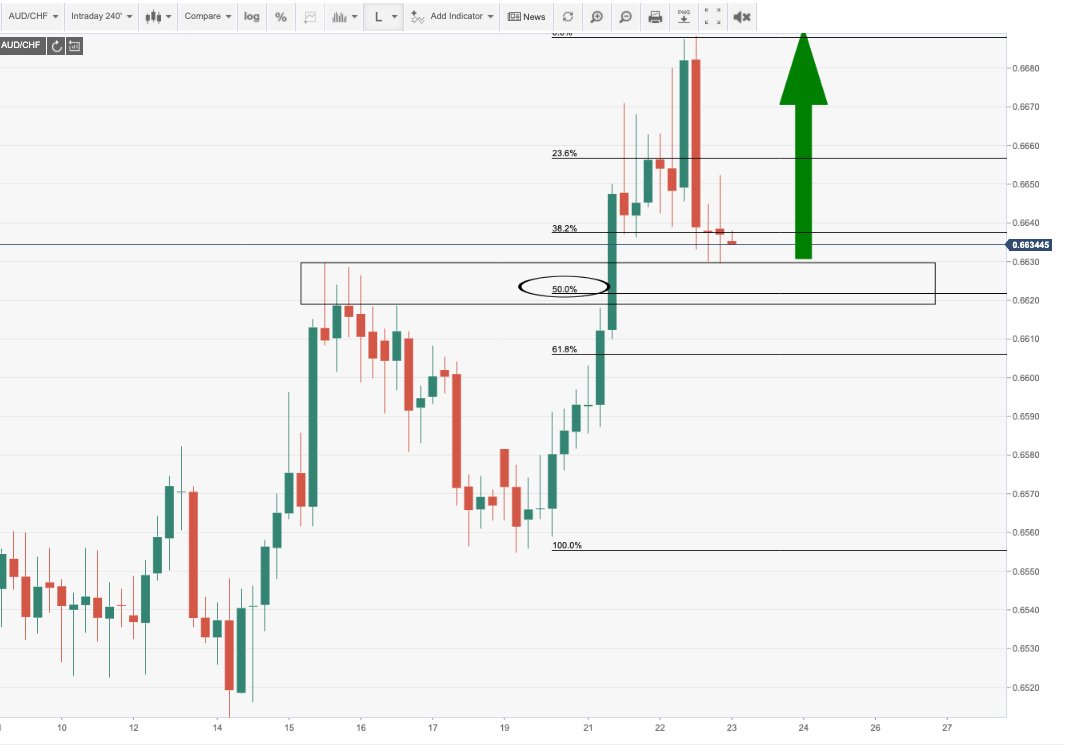

4HR corrective price action prior to next bullish impulse