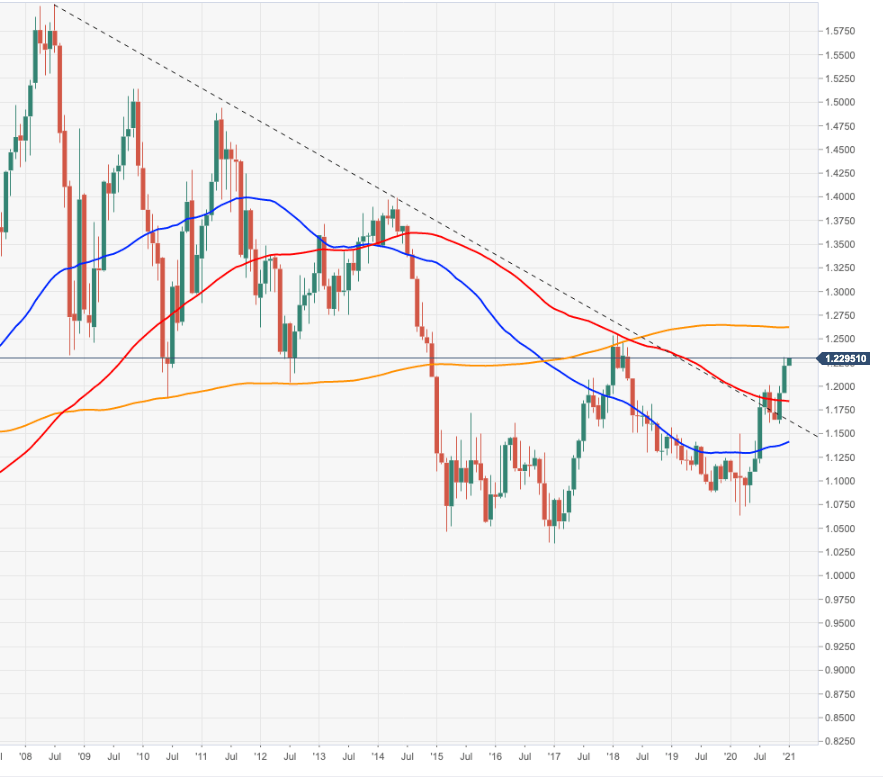

EUR/USD Price Analysis: Extra gains seen testing 1.2400 and beyond

- EUR/USD regains the 1.23 level amidst solid risk-on trade.

- Further up come in monthly peaks at 1.2413 and 1.2476.

EUR/USD resumes the upside and reverses last Thursday’s strong pullback following the rejection from yearly tops beyond 1.23 the figure.

The positive stance in EUR/USD, therefore, remains well unchanged and allows for the continuation of the uptrend in the short-term horizon. However, the proximity of the overbought territory carries the potential to spark occasional corrections. These are expected to meet initial support at the weekly low at 1.2129 (December 21).

In the meantime, a breakout of recent tops just above 1.2300 should pave the way for extra gains and a potential move to 1.2413 (April 2018 high) ahead of 1.2476 (March 2018 high).

In the meantime, extra gains in EUR/USD are likely while above the critical 200-day SMA, today at 1.1539.

Looking at the monthly chart, the (solid) breakout of the 2008-2020 line is a big bullish event and should underpin the continuation of the uptrend.

EUR/USD monthly chart