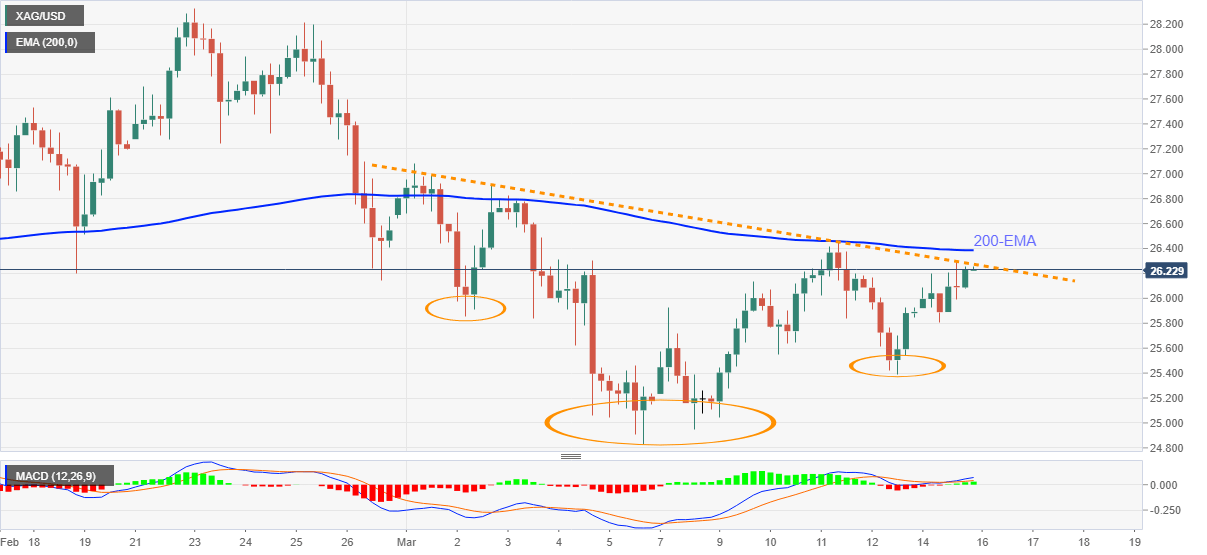

Silver Price Analysis: XAG/USD teases inverse H&S confirmation on 4H

- Silver stays firmer around the key resistance line, wobbles off-late.

- Bullish MACD suggests confirmation of the price-positive chart pattern.

- 200-EMA adds to the upside barriers, sellers await downside break of $25.38 for fresh entries.

Silver seesaws in a choppy range above $26.00, currently around $26.25, during the initial Asian session trading on Tuesday. In doing so, the white metal battles the key upside hurdle, amid bullish MACD, on the four-hour (4H) chart.

Given the upbeat MACD conditions, silver buyers confront the neckline of an inverse head-and-shoulders (H&S) formation, currently around $26.30. However, 200-EMA level near $26.40 offers an extra barrier to the north.

Considering the commodity’s ability to recover from the late January low during the last week, the corrective pullback may confirm the bullish chart formation suggesting a run-up towards the $28.00.

However, the monthly top surrounding $27.10 can offer an intermediate halt during the rise.

Meanwhile, silver sellers seem to step aside and waiting for a clear downside break below Friday’s low of $25.38 for fresh entries before targeting to refresh the yearly bottom surrounding $24.20.

Silver four-hour chart

Trend: Further recovery expected