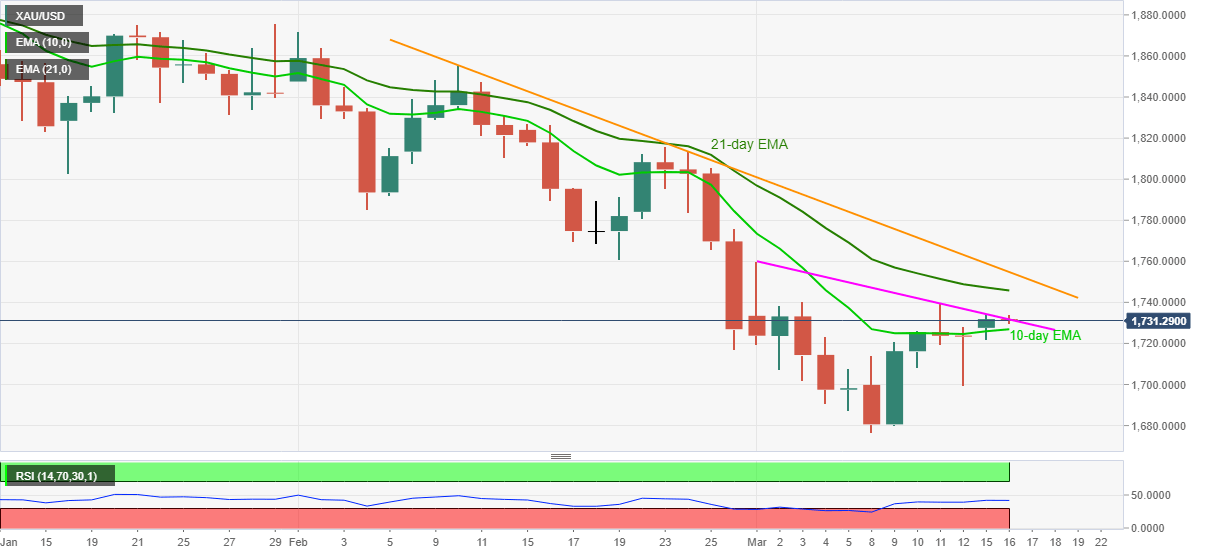

Gold Price Analysis: XAU/USD battles monthly resistance below $1,750

- XAU/USD fades upside break of a short-term EMA resistance.

- Normal RSI condition backs extended corrective pullback but multiple hurdles probe bulls.

- Fresh sellers can wait for a clear downside break of 10-day EMA.

Gold takes offers near $1,730, down 0.07% intraday, while stepping back from the day’s high of $1,734 during early Tuesday. In doing so, a downward sloping trend line from March 01 seems to defeat the yellow metal’s latest corrective pullback after it managed to cross 10-day EMA on a closing basis for the first time in March.

Even so, normal RSI conditions back the gold buyers trying to cross the $1,735 trend line hurdle in search of visiting the 21-day EMA level of $1,746.

However, any further upside beyond the stated EMA resistance will find it tough to pierce the one-month-old falling trend line, at $1,755 now.

Meanwhile, a downside break of a 10-day EMA level of $1,726 will trigger fresh declines targeting the $1,700 threshold.

In a case where the yellow metal bears keep reins past-$1,700, the monthly low near $1,676, also the lowest since June 2020, should lure the bears.

Gold daily chart

Trend: Pullback expected