Back

24 Jun 2021

Crude Oil Futures: Potential correction lower

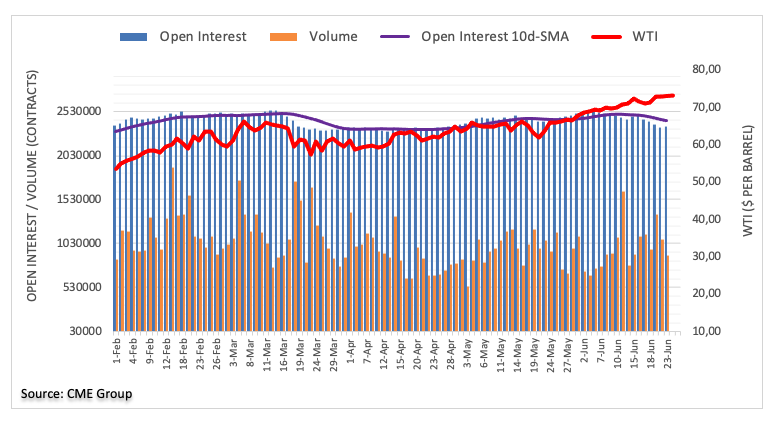

CME Group’s advanced figures for crude oil futures markets noted traders increased their open interest positions by around 15.1K contracts following four consecutive daily pullbacks on Wednesday. Volume, instead, shrank for the second session in a row, this time by more than 187K contracts.

WTI remains overbought, targets $75.00

WTI prices briefly surpassed the $74.00 mark on Wednesday, although they closed just above $73.00. The move was on the back of rising open interest and another pullback in volume. That, plus the current overbought levels hint at the view that a correction lower could be shaping up in the very near term. On the upside, the next hurdle comes in at the $75.00 mark per barrel.