Back

16 Aug 2021

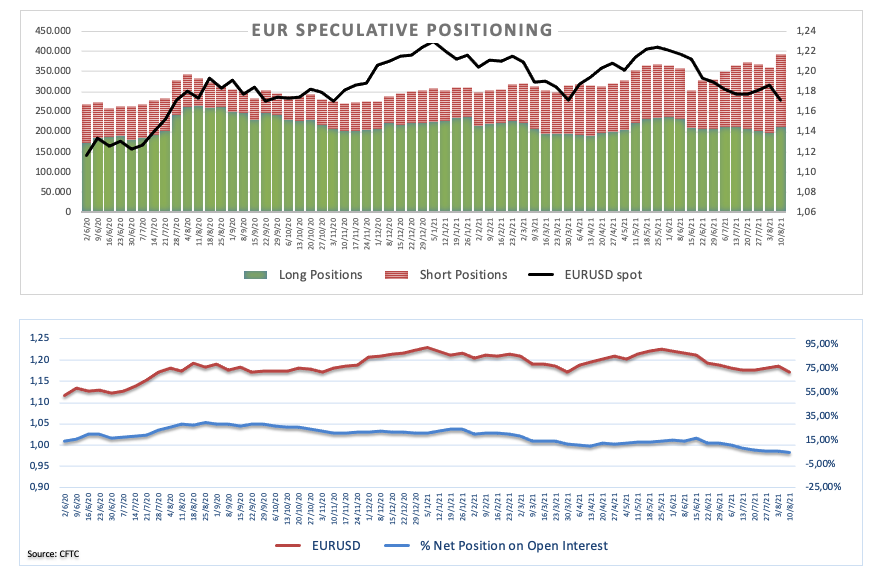

CFTC Positioning Report: EUR net longs continued to shrink

These are the takeaways of the CFTC Positioning Report for the week ended on August 10th:

- Net longs in EUR retreated further to levels last seen in mid-March 2020. The re-emergence of COVID fears and the impact on the region’s growth prospects coupled with the perseverant dovish stance from the ECB keep the downtrend well in place for yet another week.

- Investors’ perception of an earlier-than-anticipated QE tapering continued to support the interest for the dollar, helped at the same time by outflows from the risk-associated space on the back of persistent coronavirus jitters.

- Speculators returned to the positive territory when comes to the sterling after the unexpected, albeit mild, hawkish shift from the BoE at its event.

- In the safe haven universe, JPY net shorts climbed to 5-week highs while net longs in CHF rose to levels last seen in early July.