Back

29 Sep 2022

Crude Oil Futures: Further rebound looks unlikely

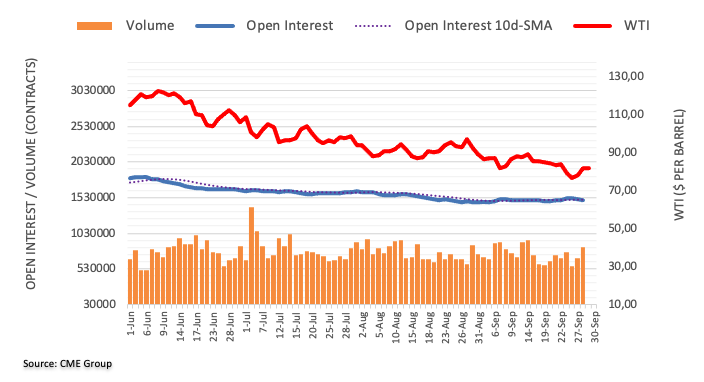

CME Group’s flash data for crude oil futures markets noted traders trimmed their open interest positions for the third session in a row on Wednesday, this time by around 6.4K contracts. Volume, instead, increased for the second consecutive day, now by more than 150K contracts.

WTI: Next on the upside comes $90.00 and above

Wednesday’s advance in prices of the WTI was on the back of shrinking open interest, which hints at the view tha extra recovery seems not favoured in the very near term. In the meantime, the monthly high at $90.37 (September 5) emerges as the next target of note for bulls.